As you know, the Thrift Savings Plan (TSP) is an extremely important part of the federal retirement system. The TSP is widely recognized as one of the finest, most elegantly simple, and popular retirement plans of its kind. As of mid-2025, the Thrift Savings Plan has over 7.2 million participants and more than $1 trillion in assets under management, making it the largest defined-contribution retirement plan in the world. However, we have found that the majority of these investors do not have the proper guidance required to maximize the growth of their savings. Our service is exclusively devoted to helping federal employees increase their thrift retirement savings. We are not affiliated with the TSP, Thrift Savings Plan, tsp.gov, frtib.gov, or any U.S. government agency or uniformed military services.

About Our Service

Our service uses a combination of a mechanical system and a rules-based system. The indicators we created for the mechanical system are specific algorithm scripts, each having settings and parameters that are proprietary. The rules-based system has specific criteria that have to be met for assigning the percentage allocations of the Thrift Savings Plan funds (G, F, C, S, and I Funds).

Performance of our TSP Allocation Service

Year 2026 YTD Returns (Updated: 01/30/26): Our members are up +2.20% year-to-date, outperforming both the buy-and-hold strategy (+2.07%) and the G Fund (+0.37%).

Year 2025 Returns: Our members profited +13.01%, which comfortably outperformed the G Fund’s modest +4.44%.

Year 2024 Returns: Our members profited +25.49%. We more than doubled the performance of the buy-and-hold strategy, which returned only +10.38%, and the G Fund up +4.40%.

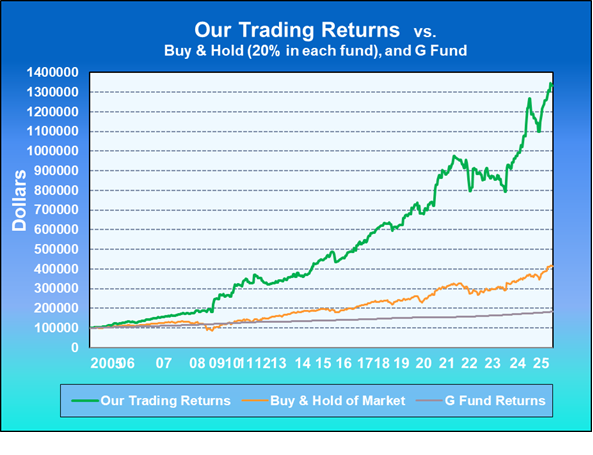

Compounded Returns: Since the inception of our service on January 1, 2005 to the end of 2025, if a member started with $100,000, their initial savings would have increased to $1,333,354 using our real-time trading returns. For the same time period, the buy-and-hold strategy of investing would have only increased to $414,382, while the G Fund increased only to $182,975. These results do not include any personal contributions during those 20 years.

Yearly Returns (2005-2025): Our TSP Allocation Service is averaging a profit of +13.23% per year in both bull and bear market cycles. Over 20 years, our service continues to lead all other TSP advisory services. The average return for the buy-and-hold strategy is +7.48% per year. We are nearly doubling the markets overall performance. The G Fund is returning an average of +2.90% per year. Our track record speaks for itself!

Subscribe today to receive our latest fund allocations and our comprehensive weekly newsletter.

All trades adhere to the New Interfund Transfer Rule. The performance bar chart and table below display our overall results:

Performance Line Chart Also, see our Performance Bar Chart Viewing the Performance Table (on the right): |

Performance Table

|

Compounding Our Performance vs. Buy-and-Hold

| Year | Buy & Hold Trades with 20% in each Fund (%) | Buy & Hold Compounded Returns starting with $100,000 | Our Cumulative Year-To-Date Returns (%) | Our Compounded Returns starting with $100,000 |

|---|---|---|---|---|

| 2025 | 14.66 | 414,382.63 | 13.01 | 1,333,354.04 |

| 2024 | 10.38 | 362,219.89 | 25.49 | 1,189,054.78 |

| 2023 | 15.94 | 328182.44 | 10.12 | 931023.94 |

| 2022 | -13.64 | 282556.67 | -9.66 | 854305.96 |

| 2021 | 10.50 | 327200.13 | 11.38 | 954186.67 |

| 2020 | 13.36 | 296707.67 | 17.18 | 854688.59 |

| 2019 | 17.16 | 261224.77 | 20.51 | 728662.92 |

| 2018 | -4.65 | 220775.18 | 2.26 | 595915.47 |

| 2017 | 13.28 | 231824.21 | 16.84 | 583970.65 |

| 2016 | 7.34 | 203255.30 | 6.73 | 495310.40 |

| 2015 | 0.34 | 189449.48 | 10.39 | 475272.01 |

| 2014 | 5.51 | 189287.41 | 14.69 | 429459.90 |

| 2013 | 16.48 | 179481.27 | 15.42 | 372873.43 |

| 2012 | 12.10 | 152592.67 | -2.15 | 320719.82 |

| 2011 | 2.11 | 136019.12 | 5.54 | 330597.13 |

| 2010 | 14.03 | 135068.28 | 15.63 | 314428.30 |

| 2009 | 25.47 | 120290.54 | 36.87 | 271436.21 |

| 2008 | -30.79 | 94221.93 | 10.59 | 194028.56 |

| 2007 | 7.01 | 130818.61 | 16.27 | 175308.19 |

| 2006 | 12.70 | 122184.92 | 21.47 | 149330.70 |

| 2005 | 7.70 | 107852.04 | 19.24 | 120968.82 |

Three primary facts to observe from the tables are: (1) the longevity of our service, (2) our long-term results consistently outperform the buy-and-hold strategy of investing, and (3) our compounded returns have tripled the returns of the buy-and-hold strategy. If your current trading style is not making these returns, we encourage you to consider our service. We are honored to serve federal government employees & military personnel who continue to prosper from our valuable service!

Our service has the best 'long-term' track record for trading the TSP Funds!

As a member you will receive:

| Instant Access |

|---|

Members will have access to the exclusive Members Only page with the latest |

| "TSPFundTrading.com's Weekly Newsletter" with Professional Chart Analysis & Commentary Sample Newletter |

The newsletter will be posted on the Members Only page each Wednesday after the close of the market to update members with our fundamental and technical interpretation of the market and the future short-, intermediate- and long-term outlook. We will provide our recommendations for attaining the highest-reward/lowest-risk in the various funds for the short-term. A few elements we will focus on include:

|

| Current Fund Distribution |

This section will provide our current percentage breakdown for the various funds in order to achieve the highest-reward / lowest-risk results. |

| E-mail Alert |

Members will receive an e-mail and/or text alert when we believe it is best to make an Interfund Transfer; meaning there has been a change in percentage distribution of funds (see sample). Members will also receive an e-mail each Wednesday after the market closes, as a reminder that our weekly newsletter has been posted on the members page. |

| First-Class Member Support |

We focus on quality customer service and respond to all emails in a timely manner. Members will receive full privacy protection, and will absolutely not receive spam or advertisements. |

|

Sincerely,

Robert W Dillon, Ph.D. Founder & Chief Technical Analyst TSPFundTrading.com, LLC Editor@TSPFundTrading.com |

|

|

|

|

|

|