Our Performance

Performance of our TSP Allocation Service

Year 2026 YTD Returns (Updated: 01/30/26): Our members are up +2.20% year-to-date, outperforming both the buy-and-hold strategy (+2.07%) and the G Fund (+0.37%).

Year 2025 Returns: Our members profited +13.01%, which comfortably outperformed the G Fund’s modest +4.44%.

Year 2024 Returns: Our members profited +25.49%. We more than doubled the performance of the buy-and-hold strategy, which returned only +10.38%, and the G Fund up +4.40%.

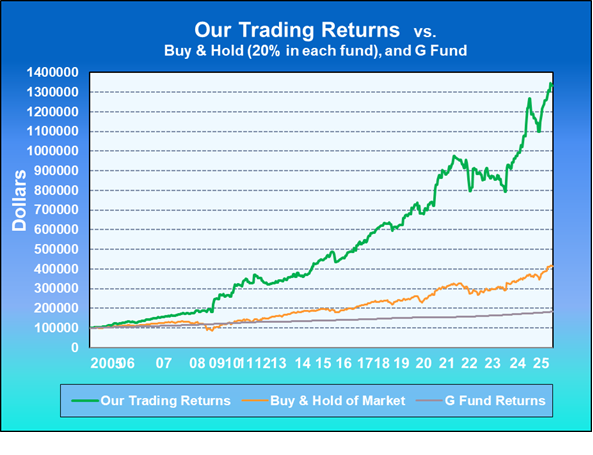

Yearly Returns (2005-2025): Our TSP Allocation Service is averaging a profit of +13.23% per year in both bull and bear market cycles. Over 20 years, our service continues to lead all other TSP advisory services. The average return for the buy-and-hold strategy is +7.48% per year. We are nearly doubling the markets overall performance. The G Fund is returning an average of +2.90% per year. Our track record speaks for itself!

Subscribe today to receive our latest fund allocations and our comprehensive weekly newsletter.

Special Note: Access to the Members page with the latest IFT distribution allotments are provided to Members only.

|

Our performance returns are independently verified by TimerTrac. |  |

How the TSP Calculates Share Price: The value of your TSP account is determined each business day based on the daily share price and the number of shares you hold in each fund. At the end of each business day, after the stock and bond markets have closed, the total value of the funds' holdings (net of accrued administrative expenses) is divided by the total number of shares outstanding to determine the share price for that day.

Our main goal is to maximize our TSP savings during bull market cycles and protect capital during potentially unstable market periods.

In addition to using technical and fundamental analysis, we are now validating our interpretation by using a mechanical impulse system. The impulse system uses a combination of trend following and momentum, which maximizes gains when the market is trending.

Compounding Our Performance vs. Buy-and-Hold

| Year | Buy & Hold Trades with 20% in each Fund (%) | Buy & Hold Compounded Returns starting with $100,000 | Our Cumulative Year-To-Date Returns (%) | Our Compounded Returns starting with $100,000 |

|---|---|---|---|---|

| 2025 | 14.66 | 414,382.63 | 13.01 | 1,333,354.04 |

| 2024 | 10.38 | 362,219.89 | 25.49 | 1,189,054.78 |

| 2023 | 15.94 | 328182.44 | 10.12 | 931023.94 |

| 2022 | -13.64 | 282556.67 | -9.66 | 854305.96 |

| 2021 | 10.50 | 327200.13 | 11.38 | 954186.67 |

| 2020 | 13.36 | 296707.67 | 17.18 | 854688.59 |

| 2019 | 17.16 | 261224.77 | 20.51 | 728662.92 |

| 2018 | -4.65 | 220775.18 | 2.26 | 595915.47 |

| 2017 | 13.28 | 231824.21 | 16.84 | 583970.65 |

| 2016 | 7.34 | 203255.30 | 6.73 | 495310.40 |

| 2015 | 0.34 | 189449.48 | 10.39 | 475272.01 |

| 2014 | 5.51 | 189287.41 | 14.69 | 429459.90 |

| 2013 | 16.48 | 179481.27 | 15.42 | 372873.43 |

| 2012 | 12.10 | 152592.67 | -2.15 | 320719.82 |

| 2011 | 2.11 | 136019.12 | 5.54 | 330597.13 |

| 2010 | 14.03 | 135068.28 | 15.63 | 314428.30 |

| 2009 | 25.47 | 120290.54 | 36.87 | 271436.21 |

| 2008 | -30.79 | 94221.93 | 10.59 | 194028.56 |

| 2007 | 7.01 | 130818.61 | 16.27 | 175308.19 |

| 2006 | 12.70 | 122184.92 | 21.47 | 149330.70 |

| 2005 | 7.70 | 107852.04 | 19.24 | 120968.82 |

If your current trading style is not making these returns, we encourage you to Join Now and become part of our growing number of federal government employees & military personnel who are prospering from our valuable service!

Graphical Representations of our Overall Performance:

Growth of TSP Savings

Performance Line Chart

Performance Bar Chart

|